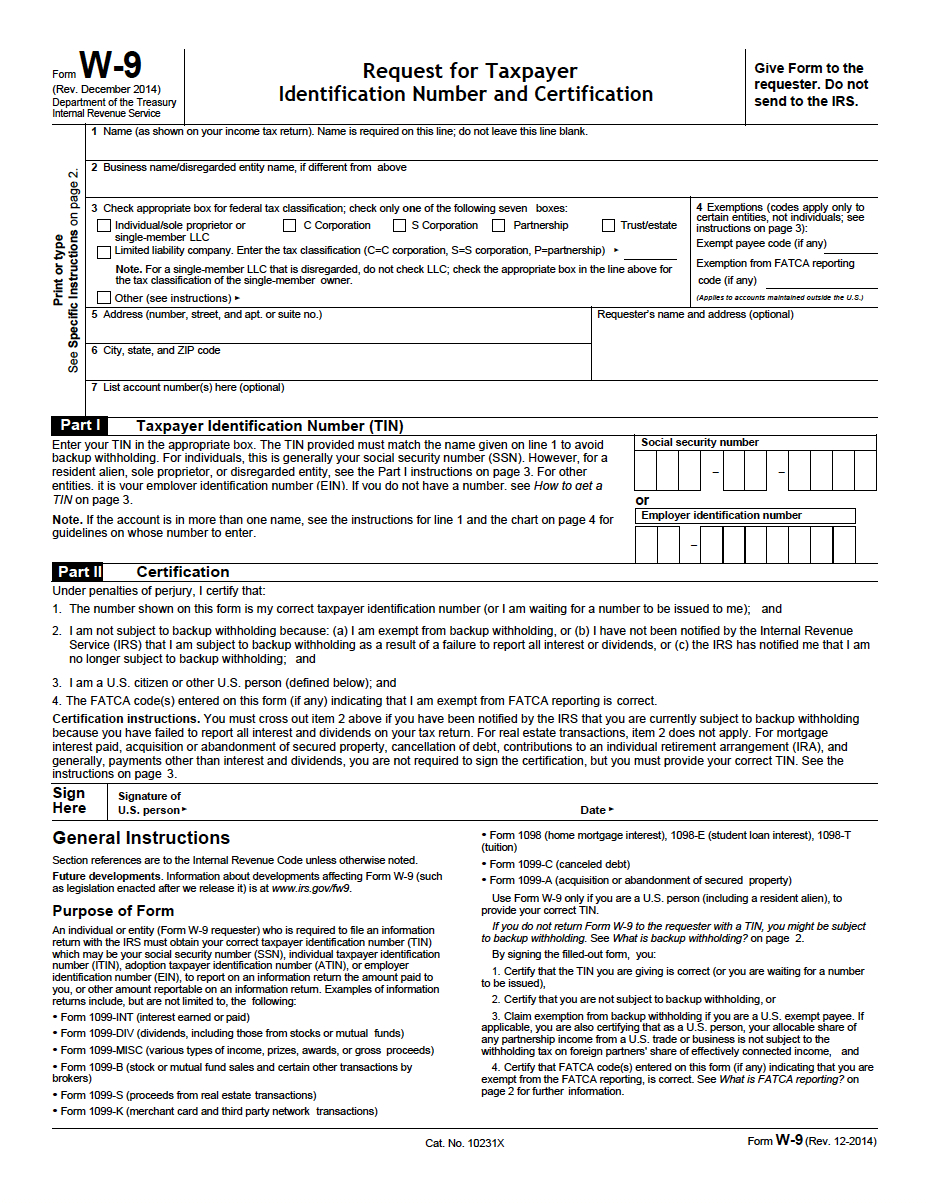

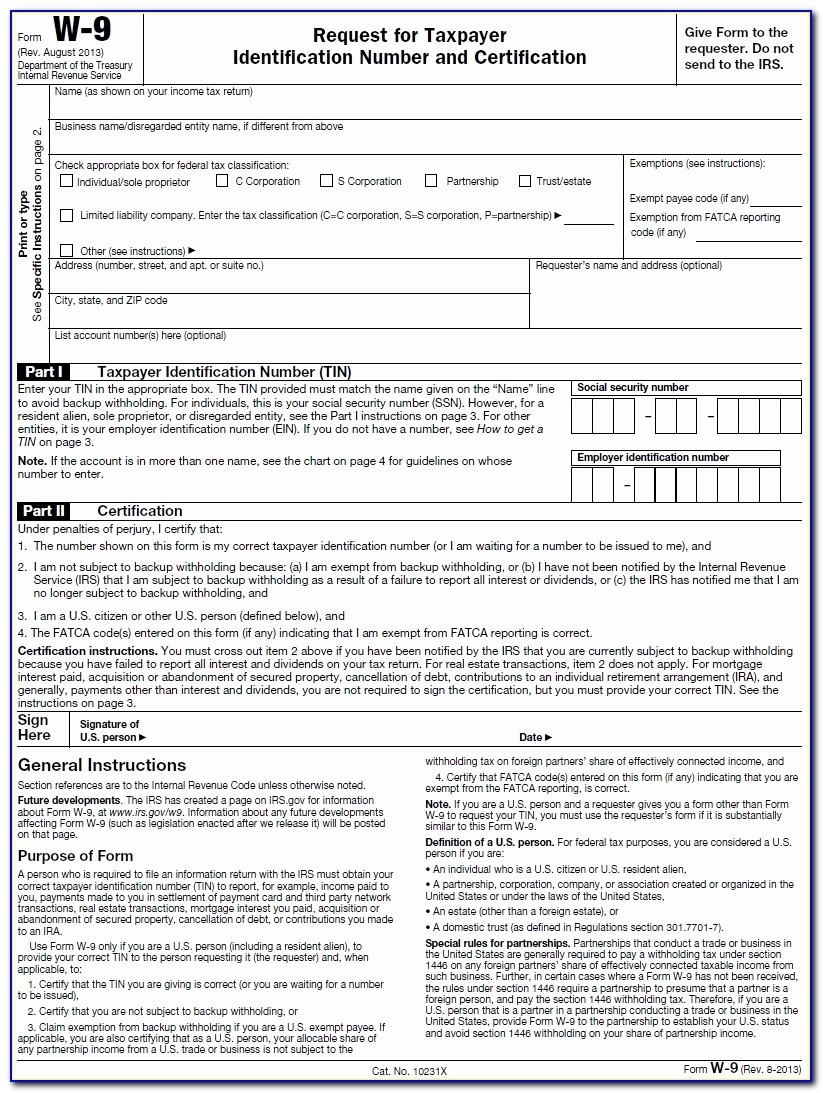

For your convenience, you can electronically fill out Form W-9 using a PDF filler application, such as PDFRun.įorm W-9 is a single-page form that consists of three sections. You may download and print a copy of Form W-9 from the official IRS website that you can fill out manually. If you are a self-employed professional, you will use Form W-9 when paying your self-employed taxes and filing your returns. Other situations may also require you to fill out Form W-9, including certain real estate transactions, paying for mortgage interest, payment of student loan interest, cancellation of debt, and earning of interest from a bank. When an entity or a business sends Form W-9 to a freelancer, independent contractor, or consultant, the recipient has to provide his or her personal and financial information, as required in the form. Companies that hire self-employed workers use it for tax-filing purposes.Įntities and individuals who are required to file an information return must obtain the Taxpayer Identification Number (TIN), Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Adoption Taxpayer Identification Number (ATIN), or Employer Identification Number (EIN), to report amounts paid to hired self-employed professionals. Form W-9, Request for Taxpayer Identification Number and Certification, is a form by the Internal Revenue Service (IRS), the federal tax agency of the United States.

0 kommentar(er)

0 kommentar(er)